Is Self-Risk the Most Overlooked Structural Risk in Your Business?

In many founder-led businesses, it’s natural for the owner to be across everything: managing key clients, signing off on every decision, overseeing finances, and steering strategic direction. In the early days, this centralised approach can create momentum. But as the business grows, so does the risk, and in most cases, it’s hiding in plain sight.

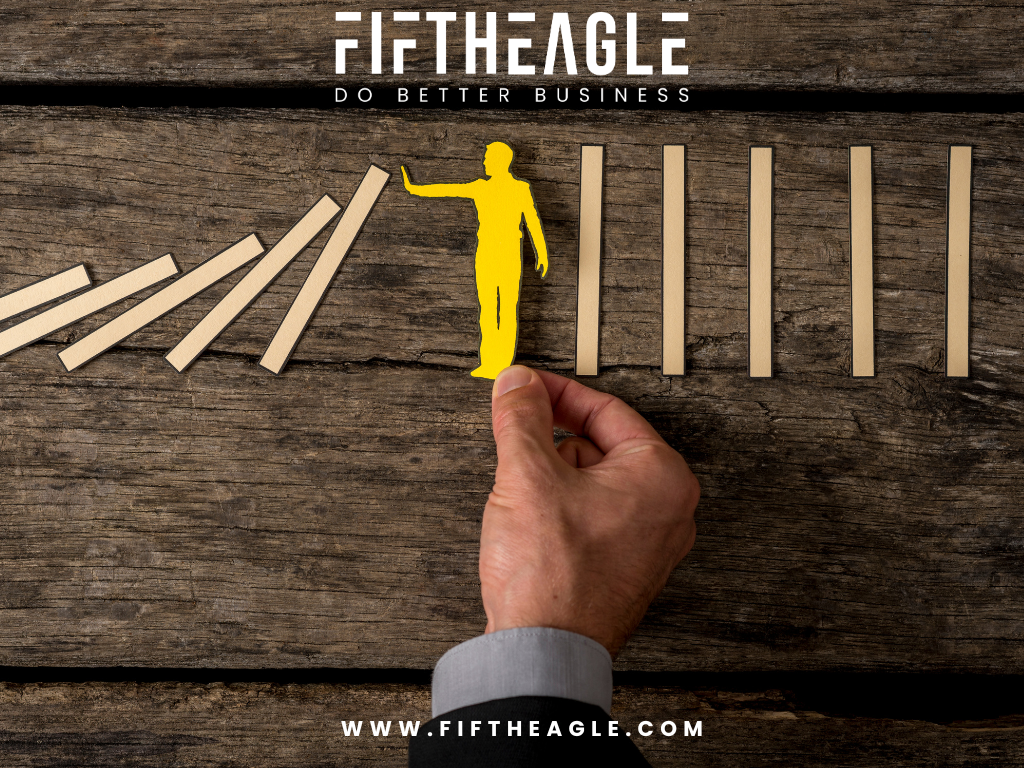

It’s called self-risk: when the business becomes too dependent on one person, usually the founder or owner, to function.

What is Self-Risk?

Self-risk is a structural vulnerability that creeps in as the business scales. It’s rarely deliberate and often goes unaddressed until a major event, like burnout, extended leave, or an attempted sale, forces it into the spotlight.

Research shows more than half of SME leaders are aware of self-risk, but fewer than a third have taken steps to address it. And when the time comes for due diligence, whether for funding, acquisition, or succession, founder dependence is a red flag. It can impact your valuation, your deal terms, and your future options.

How to Spot It

Self-risk won’t show up in your financial statements, but it’s often obvious in how the business operates. Common symptoms include:

- Staff are constantly waiting for your sign-off

- Clients or suppliers dealing exclusively with you

- Delays during your absence — even short ones

- A lack of documented processes or decision-making frameworks

We’ve seen businesses where a two-week break by the founder led to stalled client projects, delayed invoicing, and confusion across teams. In another case, a manufacturing company’s sale value was significantly reduced because the business couldn’t clearly operate without its founder.

How to Reduce Self-Risk

The good news? You don’t have to solve it all at once. Reducing self-risk is about small, intentional shifts that build resilience into your business over time. Start with:

- Documenting key processes – from quoting and billing to onboarding and delivery

- Introducing team members into client relationships to build trust and accountability

- Clarifying decision-making authority so the team isn’t waiting for constant approvals

- Testing your structure – take a break and see where things slow down

- Engaging external advisors who can support strategy and decision-making without relying on you for execution

Why It Matters

Reducing self-risk gives you more than peace of mind — it gives you leverage. It frees up your time for strategic thinking, helps your team take real ownership, and makes your business more attractive to lenders, investors, and potential buyers.

- You’ll gain more headspace to lead, not just manage.

- Financiers will see structure, not reliance, when they assess your business.

- And if you ever decide to sell or step back, your enterprise value increases.

Self-risk is common, especially in founder-led businesses, and it’s also solvable. The earlier you address it, the better positioned you are for growth, scale, and a successful exit.